Strategic Investment Report for 982432667, 617510100, 964780744, 220280055, 8559845121, 900455900

The Strategic Investment Report for the unique identifiers 982432667, 617510100, 964780744, 220280055, 8559845121, and 900455900 provides a detailed analysis of current market dynamics. It emphasizes the necessity of precise data management in identifying growth sectors such as sustainable technology and healthcare innovation. Additionally, the report highlights potential risks and suggests diversification strategies. These insights could redefine investment approaches in an increasingly complex digital market landscape. The implications of these findings warrant further exploration.

Overview of Unique Identifiers

Unique identifiers serve as critical tools in the realm of data management and analysis, enabling precise tracking and differentiation of entities across various systems.

Their strategic importance lies in facilitating accurate data interoperability, ensuring that unique entities maintain distinct identities despite being integrated into diverse databases.

This fosters enhanced decision-making capabilities, allowing organizations to optimize resources and respond effectively to dynamic market demands.

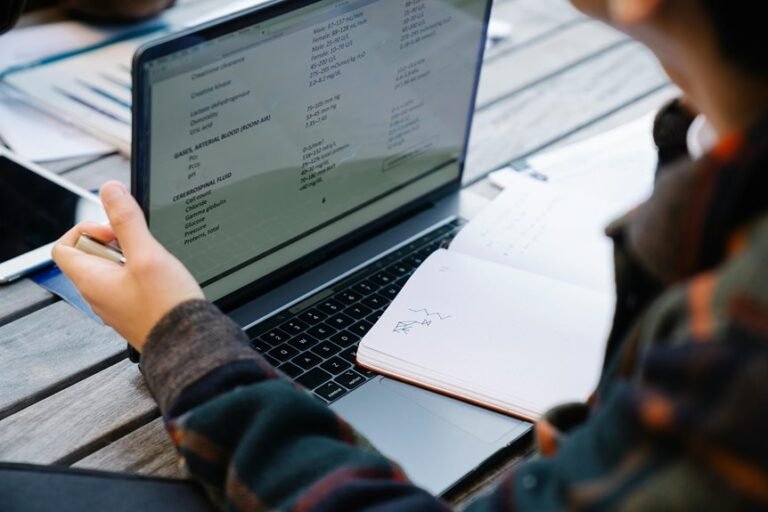

Market Trends and Analysis

As organizations navigate an increasingly complex market landscape, understanding current trends becomes essential for strategic decision-making.

Market dynamics indicate shifts towards sustainable practices and digital transformation, significantly influencing investment strategies. Data reveals that investor preferences are increasingly aligned with ethical considerations, compelling firms to adapt.

Thus, staying informed on these trends is crucial for optimizing investment portfolios and ensuring long-term viability in a competitive environment.

Growth Sectors and Opportunities

Identifying growth sectors and opportunities is crucial for organizations aiming to enhance their competitive edge in a rapidly evolving market.

Key areas include sustainable technology, which promotes environmental responsibility, and healthcare innovation driven by artificial intelligence.

Additionally, renewable energy presents significant investment potential.

As e-commerce growth accelerates, digital transformation becomes imperative for businesses seeking to capitalize on these dynamic trends.

Risk Factors and Mitigation Strategies

While numerous opportunities abound in growth sectors, organizations must remain vigilant against various risk factors that could undermine their strategic investments.

Effective risk assessment and investment diversification strategies are crucial for mitigating potential losses.

Furthermore, robust financial forecasting and adherence to compliance regulations enhance resilience against market volatility, ensuring that organizations can navigate challenges while optimizing their investment portfolios for sustained growth and autonomy.

Conclusion

In conclusion, the strategic investment report underscores the necessity of utilizing advanced data management tools to navigate an increasingly complex market landscape. By focusing on growth opportunities in sustainable technology and healthcare innovation, while employing diversification strategies to mitigate risks, investors can position themselves favorably. As the digital realm continues to evolve, a savvy investor must adapt like a modern-day alchemist, transforming data into gold through informed decision-making and compliance adherence.