5186205183: Investing in Startups – Risks & Rewards

Investing in startups presents a complex landscape characterized by both potential rewards and inherent risks. Investors must be aware of market volatility and the challenges posed by inaccurate financial forecasts. By employing a data-driven methodology, they can better assess promising sectors and competitive dynamics. This analytical approach not only aids in informed decision-making but also raises critical questions about the sustainability of investment strategies in an ever-evolving market. What factors will ultimately determine success or failure?

Understanding the Startup Ecosystem

As the startup ecosystem continues to evolve, understanding its intricacies becomes imperative for potential investors.

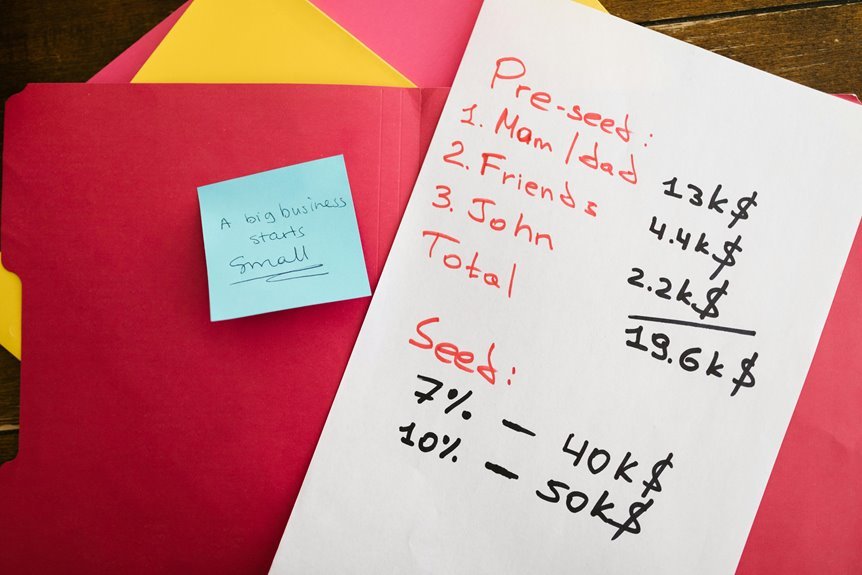

Startup funding has surged, reflecting shifting market trends that prioritize innovation and adaptability. Investors must analyze these trends to identify promising sectors and gauge competition effectively.

Evaluating Risks in Startup Investments

Investors stepping into the startup landscape must confront a spectrum of risks that can significantly impact their capital.

Market volatility presents unpredictable challenges, while inaccurate financial projections can mislead investment decisions.

Evaluating these risks requires a thorough analysis of market trends and the startup’s growth potential.

A data-driven approach allows investors to navigate uncertainties and make informed choices in the dynamic startup environment.

Strategies for Maximizing Returns

Maximizing returns in startup investments requires a strategic approach that blends analytical rigor with market insights.

Investors should employ diversification strategies to mitigate risks across various sectors, enhancing the likelihood of returns.

Additionally, effective exit planning is crucial; understanding optimal timing and methods for divestment can significantly impact profitability.

Conclusion

In conclusion, investing in startups demands a balanced assessment of risks and rewards. By understanding the startup ecosystem, evaluating potential pitfalls, and implementing strategic approaches, investors can foster informed decision-making. Through meticulous analysis of market trends and competitive landscapes, they can not only identify lucrative opportunities but also mitigate uncertainties. Ultimately, a data-driven strategy empowers investors to navigate the complexities of the startup world, enhancing their potential for substantial returns while safeguarding against inherent risks.